Fuel Frenzy: Truckers face tax tango across states

Every gallon counts, but so do the miles driven. Navigating a complex web of fuel and usage taxes adds another hurdle for truckers battling high fuel costs.

By Skip Lackey | For The Inside Lane

Every day and night, truck drivers perform a tap dance across bordering states and provinces, a routine born of money management.

The high and unpredictable cost of fuel is one of the biggest challenges faced by truckers, as it's an essential expense for keeping trucks on the road.

Finding the least expensive diesel they can is one way to manage those costs, but another decidedly more difficult route is navigating the maze of fuel tax and usage taxes that vary widely by state.

How fuel and usage taxes work

At issue is the fuel tax, a tax that is built into the purchase price of fuel paid at the pump.

- A fuel tax pays for infrastructure for the state in which the tax is paid.

- If a rig drives in a state where it does not buy fuel and, therefore, pays no fuel tax, the carrier will be charged a usage tax for the number of miles it drove and gallons used.

Carmen Martorana, CEO of the International Fuel Tax Association (IFTA), a non-profit corporation in Mesa, Ariz., said fuel taxes paid at the pump are “a dedicated source of revenue to maintain the infrastructure” of each member jurisdiction.

The association oversees the IFTA agreement, which applies to the contiguous 48 states in the United States and 10 Canadian provinces.

“So, if you are an 80,000 lb. tractor traveling through a state, and you don't stop and buy fuel (in that state), you certainly helped contribute to the damage of those roads, so you should have to pay a usage tax,” he said.

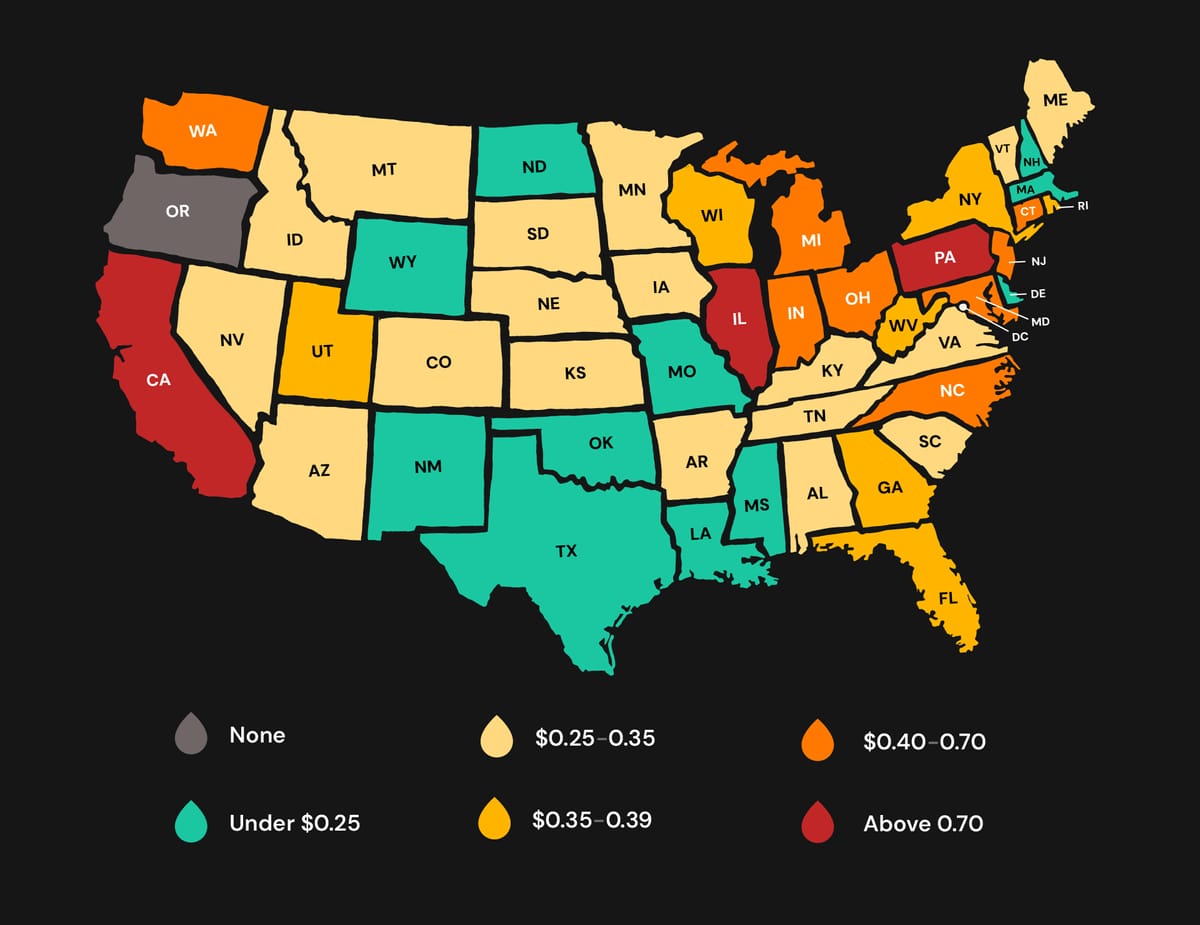

For instance - the cost of fuel tax in Nevada for the second quarter of 2024 was $.27 per gallon but in neighboring California the fuel tax skyrocketed to $1.08 per gallon. It is cheaper to buy fuel in Nevada than in California even when factoring in a usage tax.

According to IFTA internal documents, “It is the purpose of this Agreement to enable participating jurisdictions to act cooperatively and provide mutual assistance in the administration and collection of motor fuels use taxes.”

Not all states charge an IFTA-related fuel tax.

Alaska, Hawaii and Oregon don’t charge an IFTA-related fuel tax. However, because Oregon is a member of the association, the agreement applies to Oregon.

In addition, a carrier in Oregon must be licensed for IFTA and must file an IFTA return, Martorana said.

To comply with the agreement, each quarter fleet owners and owner-operators must file a “return” to their base jurisdiction, the state or province where the carrier is licensed.

The return details miles that were incurred for the quarter and the amount of fuel that was purchased in each state and province through which a commercial vehicle had traveled.

That information and other data is then transmitted to the IFTA for analysis.

Fuel tax versus usage tax

Here is an example of how the agreement works:

- A driver whose rig holds 150 gallons of fuel fills up bone dry in West Memphis, Ark. The rig gets 7 miles per gallon. It can travel 1,050 miles before its next fill-up.

- It’s about 510 miles from West Memphis, Ark., to Bristol, Va., via mostly Tennessee roads. The fuel tax for diesel in Arkansas for Q2 2024 was $0.285 per gallon.

- At 150 gallons bought in Arkansas, our driver paid $42.75 in fuel tax to Arkansas.

- The driver travels about 10 miles to Tennessee. At 7 miles per gallon, the driver incurred $0.41 of road-use tax in Arkansas, leaving a road-use tax credit of $42.34.

- The driver then travels about 500 miles across Tennessee to Virginia and fills up again in Bristol. The driver bought no fuel in Tennessee and paid no fuel tax in Tennessee.

- The fuel tax in Tennessee for Q2 2024 was $0.27 cents per gallon. To drive 500 miles in Tennessee, a driver who got 7 miles per gallon owes Tennessee $19.29.

“He owes the tax for the fuel he would have burned going across that state” at seven miles per gallon, said Grover Nelson, an owner-operator and member of Owner-Operator Independent Driver’s Association, an international trade association in Grain Valley, Mo.

That’s the bad news.

The good news? The driver has a credit in Arkansas, which offsets the usage tax in Tennessee. Subtracting the tax from the credit, the driver has a credit of $23.05 to be considered later when the next quarterly report is filed for trips made in that quarter.

Nelson said not all drivers know the pitfalls regarding the fuel tax versus the usage tax dilemma.

“Most of them don’t understand, but they don’t know they don’t understand,” he said. “I know people who got as much as a $700 to $900 bill for fuel taxes they owed.”

Tools for the industry

To aid the trucking industry, the Association publishes a quarterly Fuel Tax Matrix. You can find the Q2 2024 matrix here. Future quarters also will appear on the association’s website.

Drivers also can benefit from mobile apps to find state-by-state fuel taxes and truck-stop locations. In addition, map apps can show the distance between a specific location and another.

Have a question or comment about this article? Email Bianca Prieto at editor@theinsidelane.co

Not yet a subscriber to The Inside Lane newsletter? Join here for free.

Comments ()